Business Intelligence Software Market Report, Emerging Trends & Forecast | 2035

The business intelligence market has been a hotbed of transformative Business Intelligence Software Market Mergers & Acquisitions, with M&A serving as the primary vehicle for strategic repositioning and technological leapfrogging in a rapidly evolving industry. The most high-profile deals have been the acquisitions of leading BI platforms by enterprise software and cloud giants, a trend epitomized by Salesforce's $15.7 billion purchase of Tableau and Google's $2.6 billion acquisition of Looker. The strategic rationale behind these mega-deals was clear and compelling. The acquirers were not just buying a product and its revenue stream; they were buying a massive, loyal user community (in Tableau's case), a unique and powerful technology stack (in Looker's case), and a critical "on-ramp" to their own cloud data platforms. These acquisitions were fundamentally about controlling the entire data value chain, from raw data storage to final business insight, thereby creating a more sticky and comprehensive ecosystem for their customers. These were not just financial transactions; they were strategic chess moves in the larger war for enterprise cloud dominance.

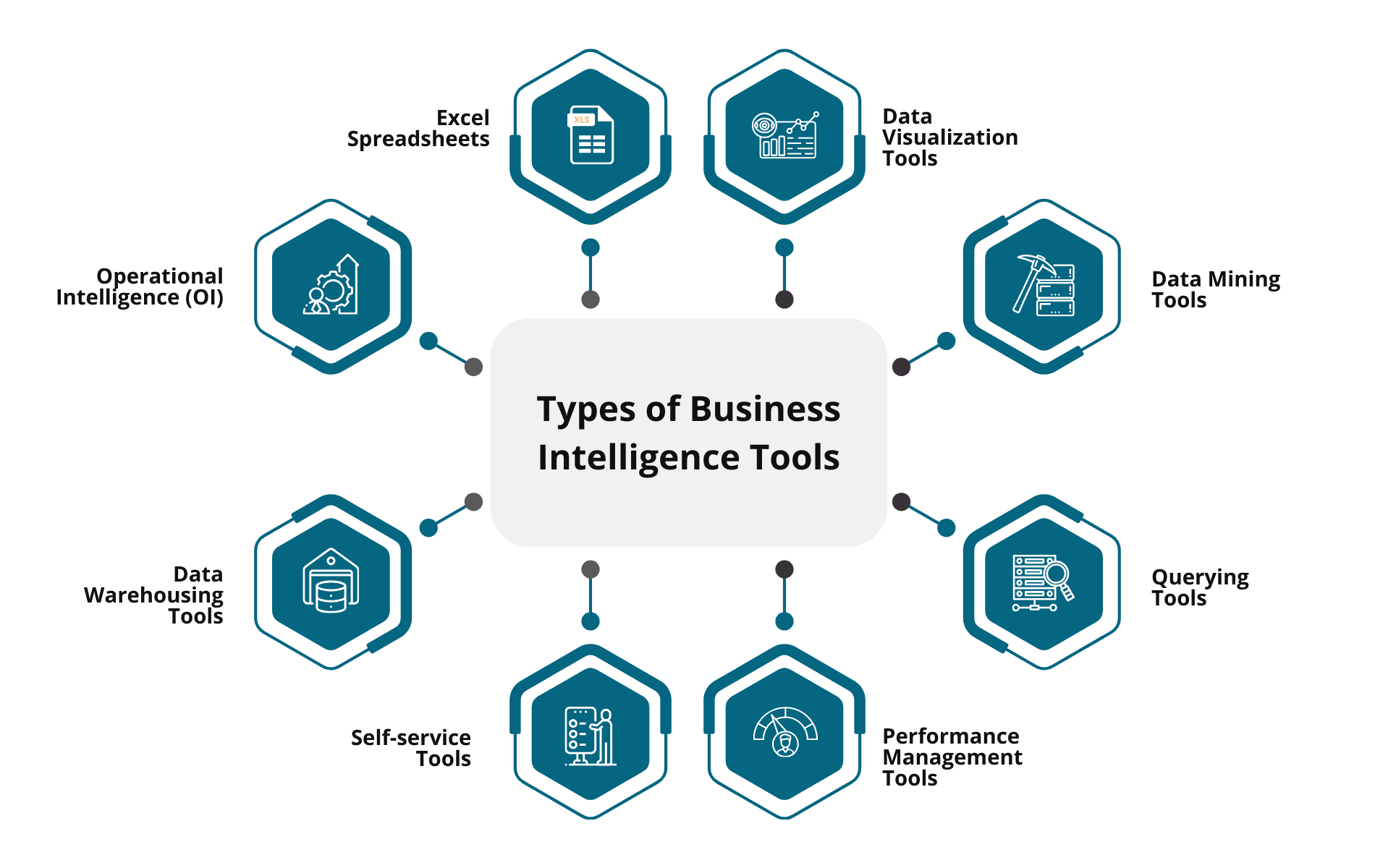

Beyond these landscape-defining mega-mergers, a second, equally important wave of M&A is occurring, where the BI vendors themselves are acting as the acquirers. As the market matures, BI platforms are seeking to expand their capabilities beyond traditional reporting and dashboarding to encompass the entire analytics workflow. This has led to a string of "tuck-in" acquisitions designed to add specific, best-in-class capabilities to their core platforms. For instance, a BI vendor might acquire a startup that specializes in advanced data preparation and data wrangling to enhance its ETL (Extract, Transform, Load) capabilities. Another might purchase a company with a powerful natural language generation (NLG) engine, allowing their dashboards to automatically generate written summaries of the key insights found in the data. Other common acquisition targets include companies specializing in AI-powered anomaly detection, predictive forecasting, or data cataloging and governance. This M&A strategy is an admission that organic, in-house R&D is often too slow to keep pace with the rapid pace of innovation in the broader data ecosystem.

Looking ahead, the future of M&A in the BI space is likely to focus on further expanding the definition of what a BI platform is. The next wave of acquisitions may target companies in emerging categories that are adjacent to traditional BI. This could include "reverse ETL" companies, which specialize in pushing insights from the data warehouse back into operational business applications like Salesforce or Marketo. It could also involve acquiring data observability platforms, which provide tools for monitoring the health and reliability of data pipelines. By making these acquisitions, BI vendors are aiming to evolve from being a passive data consumption tool into a proactive, action-oriented "data application platform"—a central hub for building and deploying a wide range of data-driven applications. This strategic evolution, fueled by targeted M&A, is essential for staying relevant in a world where data is becoming increasingly embedded in every business process. The Business Intelligence Software Market size is projected to grow to USD 55.36 Billion by 2035, exhibiting a CAGR of 4.91% during the forecast period 2025-2035.

Top Trending Reports -

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness